Muslim organisations are warning that the government may imminently scrap a halal student loan scheme if the community does not show there is a demand for it.

To prove that there is indeed a demand, the Muslim Census organisation has released a survey in partnership with Islamic Finance Guru, the National Zakat Foundation and the British Board of Imams and Scholars which you can fill out here.

They are warning that the government could scrap the scheme as early as next month if the community does not act urgently.

In 2013 David Cameron announced that the UK government would be introducing a Shariah-compliant student loan, saying: “Never again should a Muslim in Britain feel unable to go to university because they cannot get a student loan simply because of their religion.” But eight years on there has been no progress.

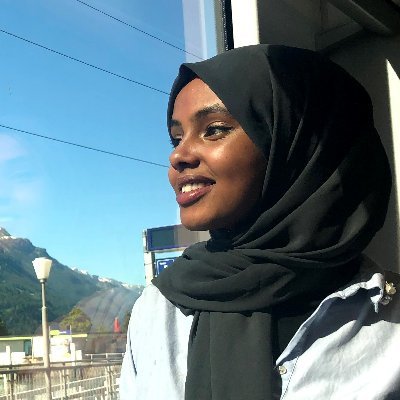

The campaign for halal student loans is being led by University of Exeter student Asha Hassan who has taken a year out of her studies to focus on ensuring the government follows through on the scheme.

Hassan met with Universities Minister Michelle Donelan last month and was told that although the scheme is ready to be implemented the government is not seeing any demand from the community itself. No decision has been made yet, Donelan said, but more evidence is needed before giving the scheme the green light.

Asha Hassan told 5Pillars: “The government has committed to an alternative solution for Muslim students but all they’ve seen over the years is an increasing number of Muslim students going to university so now they are considering scrapping all the work they have done.

Subscribe to our newsletter and stay updated on the latest news and updates from around the Muslim world!

“They have a viable solution ready which can be made available but it’s just a matter of cost and demand, so this survey is an opportunity for Muslims to show demand for a Shariah-compliant system, to show their own difficulties going to university.

“And even if you’ve already gone to university it’s important to say that this was a difficult decision to make and that you felt conflicted. At the moment the government are not hearing the stories of Muslims so if you can share your stories please.”

There seems to be a difference of opinion among scholars over whether student loans are haraam or not.

Those who argue they are not say that student loans charge interest rates that track inflation and are a necessity.

Others say that the student loan company in England and Wales now charges above-inflation interest rates and there are ways of avoiding student loans if you really want to.

Either way, campaigners say that many Muslims do view student loans as problematic and would avail themselves of a halal option if it were made available.